Selling Your Cleveland-Area Home? First, Fix That Stuck Deceased Co-Owner on the Title

Picture this: Your spouse, parent, or even an adult child passed away unexpectedly, and now the family home in Parma, Lakewood, Strongsville, Akron or Cleveland is sitting there with two names on the deed—one alive, one not. You want to sell to downsize, cash out for retirement, or just move on from the memories, but every title company, realtor, and lender is shaking their head: “We can’t insure title or close the deal until the deceased owner’s name is off the deed.”

If you’re searching “remove deceased spouse from deed Cuyahoga County 2025” or “how to sell house with dead co-owner Ohio,” you’re not alone. Hundreds of families in Greater Cleveland face this every year. The good news? Ohio law makes it straightforward—whether the deed has survivorship language or not, and whether there was a will (testate) or none (intestate). No need to wait years for probate to drag on.

This article breaks it all down: exact steps, forms, fees, timelines, and Ohio Revised Code (ORC) references tailored to Cuyahoga County. Although this is targeted towards those living in Cuyahoga County, it does apply to most Ohio Counties. We’ll cover survivorship deeds (the easy 90% of cases), full probate paths for testate and intestate estates, shortcuts for small estates, and why clearing title is non-negotiable for selling. By the end, you’ll know precisely what to file at the Cuyahoga County Probate.

First: Check Your Deed – The Magic Words That Could Save You Months and Thousands

Before anything, grab your deed. Download a free copy from the Cuyahoga County Fiscal Officer’s online portal at recorder.cuyahogacounty.us (search by parcel number or address—it’s public record back to 1810). Look at the “granting clause” near the legal description. Does it say:

- “For their joint lives, remainder to the survivor” or “as survivorship tenants”?

- Or just “John Doe and Jane Doe, husband and wife” with no extra wording?

- Or “tenants in common” (common for parent-child setups without planning)?

For Non-Survivorship Deeds: The deceased’s share (usually 50%) passes via their will (testate) or Ohio’s intestate laws (ORC Chapter 2105). You’ll need a court order like a Certificate of Transfer to clear it.

Why does this matter for selling? Title insurance companies won’t touch a cloudy deed. Buyers walk, loans fall through, and you’re stuck with carrying costs—taxes, insurance, utilities—adding up to $500–$1,000 a month in neighborhoods like Westlake or Shaker Heights.

Path A: Survivorship Deed? Skip Probate – File a Simple Affidavit and Sell in Weeks

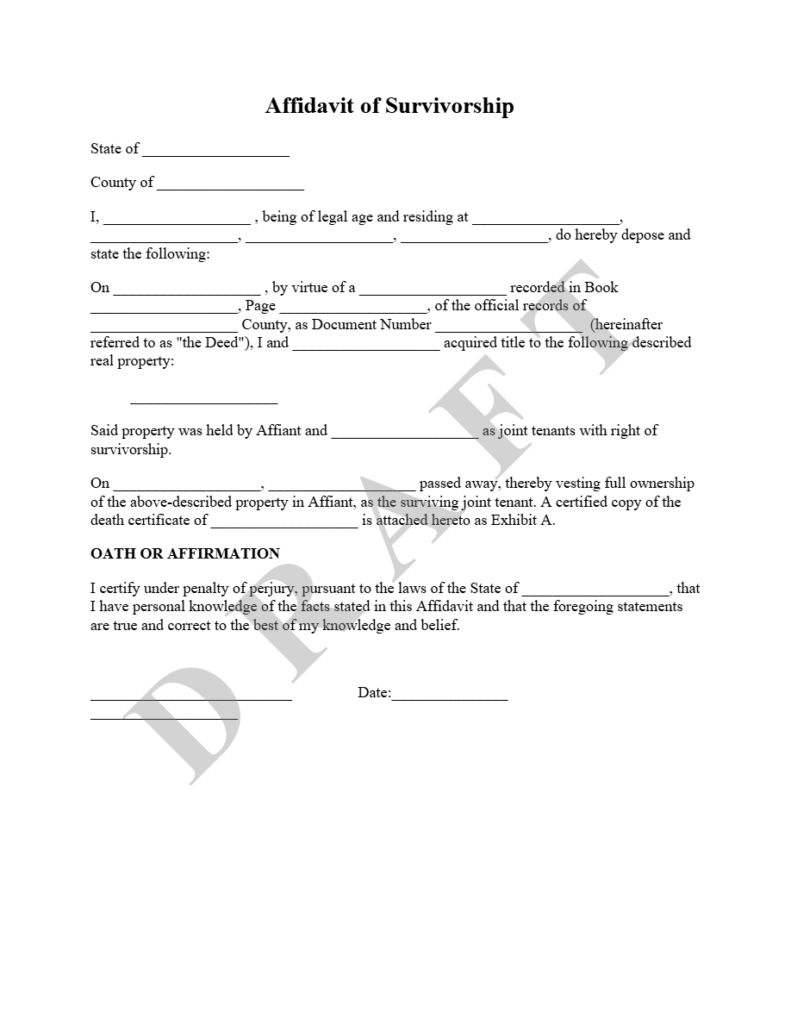

If your deed has survivorship wording, you’re golden. Ohio law (ORC 5302.17) lets you record an affidavit to officially remove the deceased’s name, updating the county records for a clean title.

Under ORC 5302.17, if survivorship language is there, the property automatically became 100% yours the moment the co-owner died. No probate required—their interest “vests” in you instantly (ORC 5302.20). This covers most married couples’ deeds since the 1980s.

Exact 2025 Steps in Cuyahoga County:

- Get the Death Certificate: Order certified copies from the Ohio Department of Health or Cuyahoga County Probate Court ($25.50 for the first, $22.50 each extra—get 10–15; you’ll need them for banks too).

- Prepare the Affidavit: Use the “Statement of Reason for Exemption from Real Property Conveyance Fee” (Form DTE 102, free download from auditor.cuyahogacounty.us). Check Box G: “Transfer by devise, bequest or operation of law.” Include:

- Parcel number (from your tax bill).

- Full legal description (copy from the old deed).

- Names, relationship, date of death.

- Notarize it (free at many banks).

- Record It: Head to the Cuyahoga County Fiscal Officer (2079 E. 9th St., Ground Floor, Cleveland) or e-record via Simplifile/LAAWS (title companies do this for $25–$50). Attach the death certificate.

- Fee: $44 for first two pages + $8 per additional (November 2025 rates—no conveyance tax on inheritances).

- Wait for Update: The Auditor syncs the change online in 3–10 business days. Print the recorded affidavit as proof.

Timeline to Sell: 1–2 weeks total. I recall a Lakewood widow who filed Monday morning, got it recorded by lunch, and had her realtor listing the house by Friday—closed 45 days later.

Cost Breakdown: $50–$150 (fees + notary). No attorney needed unless liens complicate things.

This path works for spouses, parents, or siblings on survivorship deeds. For parent-child? If it’s survivorship (rare without planning), same process. Otherwise, see below.

Path B: No Survivorship? Probate Time – But It’s Faster Than You Think for Sales

Without survivorship, the deceased’s interest goes through probate at Cuyahoga County Probate Court (1 Lakeside Ave., Cleveland). The goal: Get a “Certificate of Transfer” (Form 12.1) signed by a magistrate, then record it to vest full title in you.

Probate isn’t the nightmare it’s cracked up to be in 2025—e-filing speeds things up, and sales can proceed once title’s clear (even mid-probate). Under ORC 2113.61, the certificate acts like a new deed, exempt from transfer taxes.

We’ll split this by testate (with will) and intestate (no will), per ORC Chapters 2105–2113.

Testate Estates: Will Leaves the Property (or Share) to You

If there’s a will naming you as beneficiary for the deceased’s interest (common: “all to my spouse”), probate confirms it.

2025 Cuyahoga Steps:

- File to Open Probate: Within 3 months of death (ORC 2107.11). Submit:

- Original will + death certificate.

- Form 2.0 (Application to Probate Will) + Form 4.0 (Appointment of Executor).

- Filing fee: $225 (as of Jan 2025 updates).

E-file via the court’s portal (probate.cuyahogacounty.us) or in person. Hearing: 2–4 weeks out, 10–15 minutes.

- Get Letters Testamentary: Issued post-hearing—your “power of attorney” for the estate.

- Inventory the Estate: Form 6.0 lists assets, including the deceased’s 50% house share (value from Auditor’s site). Due 3 months after appointment. No appraisal needed unless over $35k total.

- Apply for Certificate: After inventory approval (30–60 days), file:

- Form 12.0 (Application for Certificate of Transfer).

- Proposed Form 12.1 (details heirs, will excerpts, legal description).

Magistrate signs if unopposed—1–2 weeks.

- Record the Certificate: At Fiscal Officer ($44+). Exemption D on DTE 100 (inheritance, no tax).

Timeline: 4–8 months total, but you can list the house once the certificate’s signed (proceeds held in escrow if needed).

Cost: $500–$2,500 (fees $225–$300; publication $100 if heirs out-of-state; attorney optional but smart for $1k–$2k).

Example: A Parma couple’s 1970s deed (no survivorship) with a 2015 will leaving everything to the wife. Probate opened February 2025, certificate recorded June—house sold July for $325k, net after mortgage.

Intestate Estates: No Will – Ohio’s Default Rules Kick In (Spouse-Friendly)

No will? ORC 2105.06 governs descent. For real property like your shared deed, the deceased’s share follows these rules (2025 figures, inflation-adjusted):

- Surviving Spouse + No Kids (or Kids Are Joint): Spouse gets 100% (ORC 2105.06(C)).

- Spouse + One Non-Joint Child: Spouse gets first $20,000 + 1/2 balance; child gets rest (ORC 2105.06(C)).

- Spouse + Multiple Non-Joint Kids: Spouse gets first $20,000 (or $60k if parent of some) + 1/3 balance; kids split rest per stirpes (ORC 2105.06(D)).

Parent-child deeds? If no will, the deceased parent’s share goes to all kids equally (or spouse first), potentially clouding your sole ownership.

Process mirrors testate, but it’s “Administration” (Form 3.0, $215 fee). Heirs must be notified (Form 1.0 lists them). Court confirms succession under ORC 2105.

Key Twist for Sales: If you’re the spouse and get 100%, the Certificate vests full title in you. For split interests (e.g., you + siblings), get consents or court order to sell the whole—common in land sales under ORC 2127.

Timeline/Cost: Same as testate: 4–8 months, $500–$2,500.

Real Case: Euclid mother-son deed (tenants in common, no will). Mom dies 2024; son (only child) opens administration. Intestate rules give him 100% of her share. Certificate recorded May 2025—sold June to avoid summer taxes.

The Small Estate Hack: Summary Release – Skip Full Probate If Under $35k

ORC 2113.03 offers a turbo path if total probate assets ≤ $35,000 (or spouse sole heir ≤ $100,000 mansion house allowance). Perfect for low-equity homes in Cleveland’s east side.

Steps:

- File Form 5.0 (Application for Release from Administration, $150 fee) + Form 5.1 (Assets/Liabilities) + Form 5.6 (Distribute in Kind—request transfer to you).

- Include death certificate, heir list (Form 1.0), will if any.

- Magistrate approves in 4–6 weeks—no inventory, no accounting.

- Record the Entry (like a mini-certificate) at Fiscal Officer.

Why for Sales? Clear title in 1–2 months, total cost $300–$800. Used weekly for Garfield Heights bungalows.

Special Cases: Parent-Child Deeds, TOD Designations, and Liens

- Parent-Child No Survivorship: Often “tenants in common.” Deceased’s share splits among all kids (intestate) or per will. To sell solo, buy out siblings or court-ordered partition (ORC 5307). Add 2–6 months.

- Transfer on Death (TOD) Affidavit Recorded? Since 2009 (ORC 5302.22), if filed pre-death, beneficiary (you?) files Affidavit of Confirmation (ORC 5302.222) + death cert. No probate—$44 recording. Huge for planned estates.

- Liens or Medicaid? Cuyahoga Treasurer liens for back taxes? Pay from sale proceeds post-clearance. Medicaid recovery (post-55 claims) claims against estate—settle after transfer.

- Selling Mid-Process: Realtors specialize in “probate sales.” List with disclosure; close after certificate.

Cuyahoga Quick-Reference Table: Paths, Fees, Timelines

| Deed Type | Probate Needed? | Key Forms/Docs | Timeline to Clear Title | Total Cost Est. | ORC Reference |

| Survivorship (Spouse/Child) | No | DTE 102 Affidavit + Death Cert | 1–2 weeks | $50–$150 | 5302.17 |

| Testate (Will to Survivor) | Yes (or Release) | Forms 12.0/12.1 Certificate | 4–8 months | $500–$2.5k | 2113.61 |

| Intestate (Spouse 100%) | Yes (or Release) | Same + Heir List (Form 1.0) | 4–8 months | $500–$2.5k | 2105.06 |

| Small Estate (<$35k) | No (Release) | Forms 5.0/5.6 | 4–10 weeks | $300–$800 | 2113.03 |

| TOD Designation | No | Confirmation Affidavit | 1–4 weeks | $50–$200 | 5302.222 |

Fees updated Jan 2025: Probate $215–$225; Recording $44 base. E-filing mandatory for most—call (216) 443-7420 for help.

Wrapping Up: Clear Title Today, Sell Tomorrow – Don’t Let a Deed Delay Your Next Chapter

Losing a co-owner hurts enough without paperwork paralysis. In Cuyahoga County, the system—from Lakeside’s probate clerks to Euclid Avenue’s recorders—is built for efficiency in 2025. Survivorship? One form, done. No will? Intestate laws favor spouses. Will in hand? Probate paves the path.

Start with your deed download. If stuck, the court’s self-help desk (probate.cuyahogacounty.us/forms) has checklists. For sales, loop in a local realtor early—they know probate-savvy buyers.